Race to the Bottom: The New Fuel Surcharge Reality

Back in 2014, KSM Transport Advisors (KSMTA) warned carriers against treating linehaul and fuel as separate debates and urged evaluating every customer and lane on an all-in “LH+FSC” basis. That guidance has become urgent. Shippers are increasingly adopting Breakthrough’s Fuel Recovery, which carves fuel into a precise, shipment-level pass-through (daily, wholesale-leaning, tax-aware, lane-specific) and encourages procurement teams to treat FSC as settled science. Once fuel is fenced off, the negotiation (and the pressure) moves to linehaul, setting up systematic compression of LH+FSC.

Thus far in 2025, roughly 40% of our clients’ RFPs mandate Breakthrough. We’re seeing the expected lane-level FSC deflation and, more troubling, a drag on all-in rates, at a time when many carriers are still running north of a 100 OR. It’s the divide-and-conquer dynamic MIT Professor Chris Caplice has chronicled: with fuel “fixed,” data-driven RFPs and continuous re-rates shift volatility and cost back onto the carrier.

Linehaul and fuel surcharge (FSC) have long been negotiated as separate elements. In KSMTA’s FreightMathTM practice, we calculate what total price (LH+FSC) is required on each lane. The LH price returned to the shipper is the total price minus the shipper specific FSC. The problem with Breakthrough is that the carrier does not know with certainty what the FSC will be.

What’s new is that Breakthrough’s Fuel Recovery program isolates FSC as a precise, shipment-level pass-through, and then encourages shippers to treat it as settled science during RFPs. Breakthrough’s stated core objective is to estimate the “true cost” of fuel considering the geographic fuel cost and taxes, and blanket gauge on fuel efficiency. However, the actual effect is to divide and conquer: push FSC out of the negotiation and deflate the total rate per mile (RPM) by applying relentless pressure on linehaul. That dynamic squares with broader procurement shifts described by Caplice (MIT FreightLab), where increasingly data-driven and dynamic practices allow shippers to re-optimize, reprice – all more frequently, shifting cost and volatility back onto carriers.

This article deconstructs Breakthrough from a carrier’s vantage point. It explains the mechanics, surfaces where risk migrates to the carrier (MPG, deadhead, detention, payment timing, and opacity), and lays out a pro-carrier playbook for pricing, contracting, and post-delivery operations so carriers can protect margin while engaging shippers that require Breakthrough.

Reader Note: Carriers should be aware that Breakthrough is not simply focused on fuel/fuel surcharges, it is also now aggregating and selling carrier and broker linehaul rates back to its shipper clients. All carriers we spoke to were unaware of the fact that Breakthrough is monetizing their linehaul rates via existing shipper customers, via their Capac-ID product.

Question for reader: Do your shipper contracts provide the explicit approval to provide these rates to Breakthrough?

Part I: Deconstructing the Breakthrough Fuel Recovery Model

What Breakthrough Changes and What It Doesn’t

Carriers have traditionally billed linehaul and recovered fuel through a surcharge tied to the EIA/DOE’s weekly diesel price index. While this method is simple and predictable, it relies on a lagged national retail average that doesn’t capture lane-specific or day-to-day fuel costs.

Breakthrough’s Fuel Recovery replaces that with a lane/day calculation built on four adjustments (time, price, tax, and geography) to, purportedly, better reflect shipment-specific conditions. In practice: daily pricing (not weekly), a wholesale-leaning basis (not retail), state-by-state tax treatment, and lane-specific geographies, and the assumption that you actually buy fuel near or in between origin and destinations.

Breakthrough openly markets the outcome: shippers pay less than under DOE schedules (e.g., claims of ~40¢/gal “spread” vs. traditional surcharges), which, when FSC is fenced off during RFPs, pressurizes linehaul and drives down total RPM. That’s the deflation we observe on the carrier side.

The Black Box and Information Imbalance

Although Breakthrough shares inputs, its algorithm is proprietary (reinforcing the move away from transparency. Carriers get a daily fuel report and can query shipments in the FELIX portal, but they cannot independently verify the reimbursement calculations. This lack of transparency gives more leverage to the shipper or third party and makes carrier forecasting and auditing more difficult.

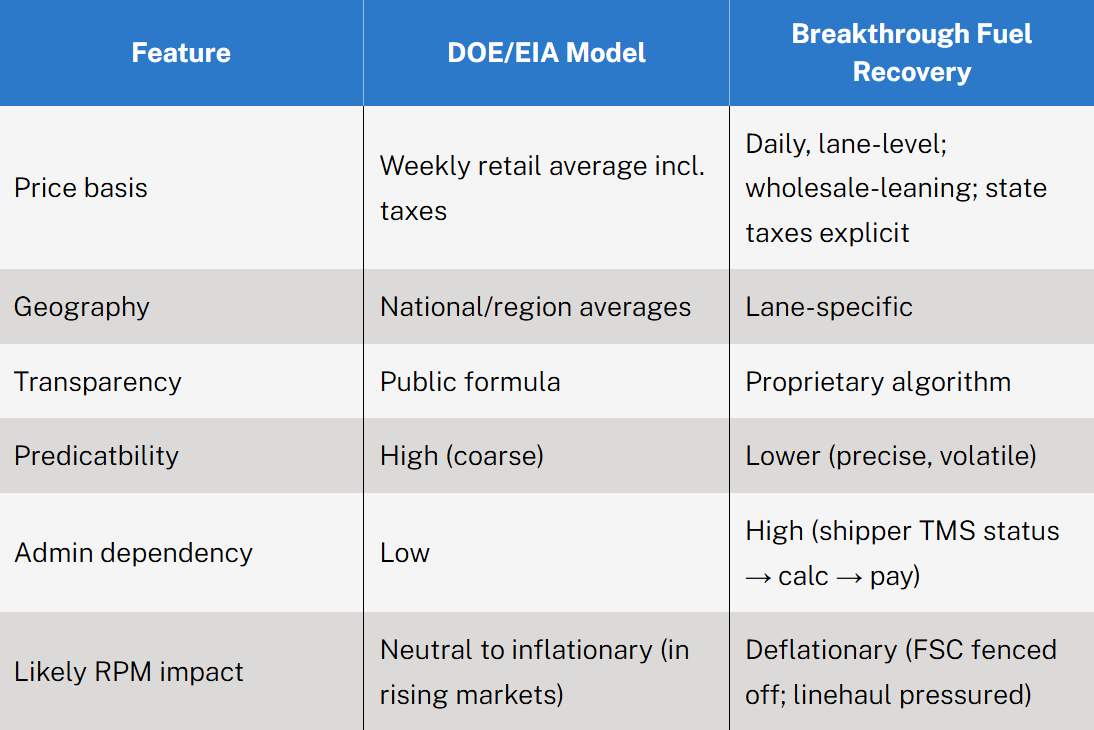

DOE vs. Breakthrough (Carrier Lens)

Part II: The Carrier’s Operational Reality

The MPG Lever: Small Number, Big Dollars

In Breakthrough’s math, MPG converts miles into reimbursed gallons. Shippers, armed with network averages and “improvement” narratives, have clear incentives to set higher MPG standards. Moving a standard from 6.0 to 6.5 MPG on an 800-mile haul cuts reimbursed gallons ~7.7%, and thus total FSC dollars, every time. That gap must land in linehaul or it lands on carrier margin. (Breakthrough case studies highlight pushing efficiency benchmarks.)

What’s Not Covered: Deadhead, Detention, Idling

Fuel Recovery is about the load movement, not the true end-to-end service. Deadhead to pick-up, detention (idling), or yard moves aren’t reimbursed. Under DOE tables, these were often partially buffered; under Breakthrough, carriers must explicitly price these into linehaul to avoid margin erosion.

Procurement Dynamics: Why Deflation Happens

Caplice’s research shows that traditional RFPs and routing guides perform poorly in volatile markets. Today, shippers use data-driven tools like dynamic contracting, mini-bids, and re-rates to cut cost and uncertainty. When fuel is standardized through Breakthrough, those tools push competition onto linehaul rates, driving RPM down – a pressure carriers feel directly.

Part III: A Pro-Carrier RFP Playbook

Pre-RFP Due Diligence (Non-Negotiables)

Ask shippers for the following information whenever a new Fuel Surcharge Program is implemented:

- Index & Inputs: Name the wholesale price source used; define tax methodology; document any adjustments

- MPG Standard: Value, basis (your fleet vs. network vs. benchmark) and change governance (mutual vs. unilateral)

- Triggers & Timing: Exact TMS status updates that trigger calculations; days from POD to fuel posting; penalties for shipper-side delays

- Data Access: FELIX access, daily files, API options; audit rights and dispute SLAs

If answers are vague, that’s a red flag for cash-flow risk and future disputes. (Breakthrough confirms daily reporting/FELIX access. Carriers should demand it by contract.)

Build a Resilient Cost-Plus Linehaul

Treat FSC as a cost offset, not margin. Use linehaul to recover lost revenue as a result of transition to Breakthrough Fuel Recovery.

- Base ops CPM on loaded miles: driver, tractor/trailer, insurance, maintenance, overhead

- Uncompensated fuel: deadhead miles ÷ fleet MPG × fuel price; detention hours × idle burn × fuel price

- FSC shortfall vs. DOE plus a volatility premium (recognize day-level swings)

- Cash-flow/admin premium for reconciliation and billing delays

- Profit appropriate to risk

Caplice’s portfolio thinking supports segmenting lanes and aligning contract form to risk (e.g., indexed or tiered pricing, guaranteed volumes, or dedicated for volatile corridors, tools that stabilize utilization and protect yield).

Contract Language That Actually Protects You

Lock the economics in writing:

- Fuel Addendum: Name the price index, spell out MPG, and require mutual consent + notice period for changes

- Timing & Remedies: Max days from delivery to fuel posting/payment; interest/fees for shipper-caused TMS delays

- Dispute Process: Evidence required, SLA to respond/resolve, and escalation path

- Data & Audit: FELIX/API access, daily files, and audit rights for your specific shipments

- Data Rights: Limit permissions/contract language so the shipper may only share fuel or fuel-surcharge related information; remove any language that allows sharing of broader rate data

Part IV: Why This Is Deflationary and How To Counter It

- Shipper Narrative: “We’ll make you whole on fuel, precisely and fairly, so let’s focus on linehaul” (Breakthrough’s own marketing centers on eliminating shipper overpayment.)

- Procurement Reality: With FSC fenced as a pass-through and measured against aggressive MPG standards, the competitive pressure concentrates on linehaul, compressing total RPM

Control the Levers You Can See and the Ones You Can’t

Breakthrough doesn’t simply fix fuel – it reframes the RFP. If carriers accept FSC as a black box and leave MPG, timing, and data access undefined, they’ll watch total RPM deflate and margin leak away. If carriers negotiate the mechanics (index, MPG, triggers, SLAs, audit rights), price with a cost-plus discipline, and automate the back office, they’ll convert a deflationary tool into a manageable input.

Caplice’s research is clear: data-driven, dynamic, and portfolio-based contracting reduces uncertainty and favors prepared counterparties. Bring that playbook to Breakthrough engagements, and make it work for you, not to you.

Breakthrough is marketed as a tool that allows shippers to reduce their transportation spend. Carier beware: Breakthrough delivers on this marketing point.

To learn more or discuss any of the ideas shared above, please contact a KSMTA advisor via the form below.

- EIA/DOE methodology for weekly retail diesel survey (timing, coverage): U.S. Energy Information Administration

- Breakthrough materials on Fuel Recovery mechanics (time, price, tax, geography); daily reports; FELIX portal. Breakthrough Fuel Explained

- Caplice, Reducing Uncertainty in Freight Transportation Procurement (MIT FreightLab), on dynamic procurement, portfolio management, and contracting innovations.

Related Content

We're Looking for

Remarkable People

At KSM, you’ll be encouraged to find your purpose, exercise your creativity, and drive innovation forward.