The State of M&A: A Look Back at 2025 and the Year Ahead

Summary: Middle-market M&A in 2025 favored businesses with durable cash flows, recurring revenue models, and disciplined operations, as buyers evaluated earnings quality, revenue recognition, working capital, and EBITDA sustainability. This recap examines key sectors and the diligence themes shaping industrials, business services, technology, transportation and logistics, consumer, and healthcare, along with considerations for 2026.

After an extended period of uncertainty, deal activity in 2025 reflected cautious confidence as buyers and sellers adapted to normalized interest rates, moderated valuation expectations, and heightened diligence standards. Rather than a broad-based rebound, activity returned unevenly across sectors, with transactions increasingly centered on businesses demonstrating durable cash flows, operational discipline, and realistic growth strategies.

Against this backdrop, KSM’s Transaction Advisory Services (TAS) Group delivered another standout year, continuing its rapid growth and deepening its impact across the middle market.

KSM’s Strategic Growth

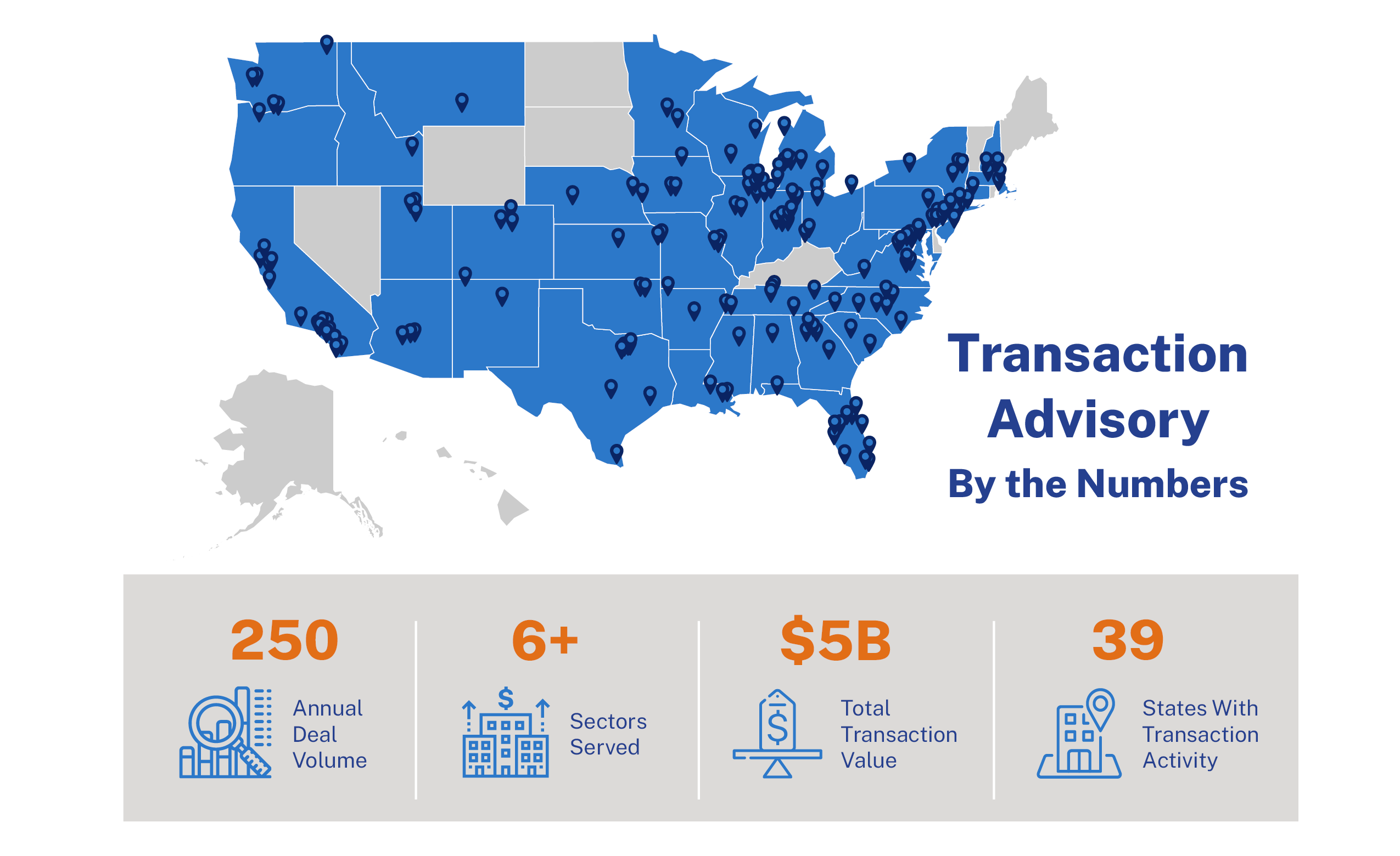

With deal volume of 250 transactions annually, our deal activity reflects sustained engagement across the lower and middle market, climbing to roughly $5 billion in aggregate deal value.

With deal volume of 250 transactions annually, our deal activity reflects sustained engagement across the lower and middle market, climbing to roughly $5 billion in aggregate deal value.

Deal activity spanned 39 states, underscoring the geographic reach and sector depth of our work. A significant portion of our engagements involved businesses utilizing percentage-of-completion revenue models, highlighting our experience navigating complex revenue recognition considerations and assessing earnings quality.

These results highlight not only increased deal volume but also the trust placed in KSM to navigate complexity, mitigate risk, and support informed decision-making throughout the transaction lifecycle.

In addition to client-driven momentum, 2025 marked a pivotal year for KSM’s own growth. We expanded into the Chicago market through the acquisition of MichaelSilver and established KSM’s sixth office location. Following recent growth in the New York City and Cincinnati markets, this expansion deepens our presence in key markets and enhances our ability to support clients from initial strategy to closing.

Sector Trends: What We Saw in 2025

Industrials: Consistent Activity Driven by Operational Strength

Industrials remained one of the most active sectors in 2025, supported by steady demand for essential products and services, fragmented markets, and ongoing consolidation opportunities.

Buyers focused on platform and add-on acquisitions involving businesses with backlog visibility, pricing power, and exposure to infrastructure investment and reshoring trends. While valuation multiples moderated, high-quality assets continued to attract competitive interest. Industrials are expected to remain a core driver of M&A activity into 2026.

Business Services: Quality, Recurring Revenue, and Discipline

Business services experienced some of the strongest growth in deal activity during 2025. Transactions emphasized recurring or contracted revenue models, defensible market niches, and professionalized operations. Labor availability, margin sustainability, and customer concentration remained central diligence considerations. Looking ahead, demand is expected to remain strong for businesses supporting regulatory compliance, operational efficiency, and outsourced professional services.

Technology and Software as a Service (SaaS): A Disciplined Market

Technology and SaaS activity remained measured as buyers maintained discipline following valuation resets in prior years.

Successful transactions favored companies offering mission-critical solutions, strong customer retention, and scalable infrastructure. Growth remained important, but profitability, unit economics, and margin expansion played a more prominent role in investment theses. With capital markets stabilizing, 2026 may bring renewed confidence for technology companies demonstrating sustainable performance.

Transportation and Logistics: Adjusting to Normalized Conditions

Buyers prioritized operators that managed cost pressures effectively, optimized asset utilization, and maintained customer relationships amid shifting demand patterns. Despite margin pressures, well-run businesses continued to attract interest, and consolidation is expected to persist into 2026.

From our perspective, lower-middle market transportation and logistics deals are placing greater scrutiny on earnings durability, with buyers focused on normalizing earnings before interest, taxes, depreciation, and amortization (EBITDA) for fuel pass-throughs, owner compensation, and non-recurring freight surges from prior years. Working capital and cash-flow quality are key diligence themes, particularly around receivables collectability, customer concentration, and the sustainability of margins as pricing and volume normalize. Buyers are also closely examining revenue recognition, contract terms, and capital expenditure vs. maintenance spend to assess true free cash flow and support valuation in a more disciplined market.

Consumer: Selectivity and Brand Strength

Consumer transactions remained selective, with buyers focusing on brand strength, pricing discipline, and margin management. Companies with loyal customer bases, clear value propositions, and resilient supply chains were better positioned to navigate evolving consumer behavior. Opportunities in 2026 are expected to favor adaptable consumer businesses with proven demand durability.

Healthcare and Other Targeted Sectors

Healthcare deal activity remained targeted, driven by interest in scalable service models, favorable reimbursement dynamics, and operational efficiency. Additional activity occurred across financial services, energy, and environmental services, often tied to niche specialization and long-term demand fundamentals.

Looking Ahead to 2026

As 2026 begins, the middle-market M&A environment appears cautiously optimistic. While macroeconomic uncertainty persists, valuation expectations between buyers and sellers continue to align.

Deal activity is expected to increase among businesses with strong fundamentals, clear growth strategies, and operational readiness. For organizations considering a transaction – whether buying, selling, or preparing for the future – early planning, rigorous data preparation, and informed market insight will remain essential. With KSM’s acquisition of Charter Capital Partners, our transaction advisory practice is looking forward to further geographic expansion into Michigan.

KSM’s TAS team enters 2026 well-positioned to continue helping clients navigate complexity, unlock value, and execute with confidence.

Need help with your next deal? Contact us via the form below.

Related Content

We're Looking for

Remarkable People

At KSM, you’ll be encouraged to find your purpose, exercise your creativity, and drive innovation forward.