Tips for Reporting Uninstalled Materials

The implementation of Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606), required for non-public companies for periods beginning after Dec. 15, 2018, has most likely impacted the financial statements of subcontractors or any contractor with material-intensive contracts. There are many changes from the previous standard (Topic 605), but for certain contractors, Topic 606 may require a more thorough periodic analysis of contracts for uninstalled materials.

This has caused many questions such as: what are the key takeaways from the new standard? What is the best way to analyze contracts for uninstalled materials and improve reporting to comply with the new standard? How can this be integrated with a work in process (WIP) schedule?

Understanding How the New Standard Impacts Uninstalled Materials

The Financial Accounting Standards Board’s primary goal with the new revenue recognition standard was to improve comparability of revenue recognition practices across entities and industries, and to provide more useful information to users of financial statements through improved disclosure requirements.

Specific to the construction industry, one of the many guidelines set forth by Topic 606 was clarity and more practical accounting practices for uninstalled materials. Previously, under Topic 605, if materials were delivered to a jobsite but not immediately installed, the cost of the materials would be accounted for as inventory on the balance sheet until installed. Therefore, no cost or profit would be accounted for until installed. As the materials were installed, the respective cost and profit margin would be recognized. This did not align with how the construction industry views materials and thus created diversity in practice.

Under Topic 606, uninstalled materials may be recorded as job cost on the WIP, but at zero margin. As the materials are installed, the margin is recognized over time (i.e., percentage of completion method).

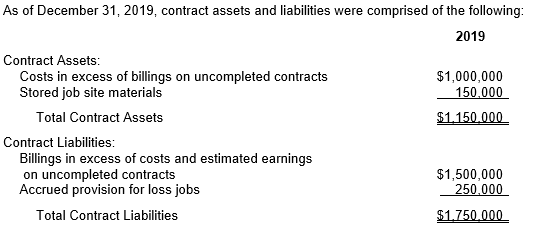

Additionally, Topic 606 introduced the balance sheet classifications “contract assets” (primarily underbillings) and “contract liabilities” (primarily overbillings). Overbillings and underbillings are the most frequent assets and liabilities, but other items may also fall under these categories. For example, contract assets may include uninstalled materials and contract liabilities may include an accrual for loss jobs. In any case where contract assets/liabilities include more than over/underbillings, enhanced disclosure is required. See the example below.

As of Dec. 31, 2019, contract assets and liabilities were comprised of the following:

Tips for Proper Reporting of Uninstalled Materials

Once the accounting concepts are understood, the next step is to determine an efficient and effective process to identify the uninstalled materials to be considered for reclassification and further work. In general, this should identify jobs that are more material-intensive and therefore more likely to end up with a large shipment of uninstalled materials at any time throughout the completion of a job.

Ideally, it would be best to implement a searchable code to identify material-intensive jobs, which would be attached to every contract when initially set up on the WIP schedule. For example, material-intensive jobs could be marked with an “MI” while more labor-intensive jobs could be “LI.” This would speed up the process at month/quarter/year-end and slim down the number of jobs that would need to be evaluated for uninstalled materials. Additionally, educating PMs/PAs on the importance of noting the timing of when materials are delivered to their jobsite will increase efficiency in the process of evaluating uninstalled materials. If PMs/PAs routinely track these more material-intensive jobs, frequent reporting would be less cumbersome.

Jobs with potential uninstalled materials may be easily identified with a quick glance, especially those with no billings yet on the job (i.e., materials were delivered to the site to get the job started but work has not yet begun). Further, it is helpful if your accounting system has a function which generates a report to run on those particular jobs to see the material versus labor amounts. The jobs with little-to-no labor with significant material costs would be flagged for uninstalled material treatment.

Options for Recording Uninstalled Materials

What is the best way to implement these new rules into jobs and WIP schedules? Select one of the following three primary methods, based on your unique company needs and circumstances.

Add an Additional Column to the WIP Schedule

Tracking uninstalled materials will impact actual costs incurred to date. As such, the first option is to add a separate column following the actual incurred costs. Actual incurred costs would include uninstalled materials, and the new column would include uninstalled materials only. Then, add an additional adjusted costs to date column that subtracts out the uninstalled materials. The percentage of completion and related revenue, gross profit, and over/under billings would be calculated based on this new adjusted column. See below for an illustrative example of how to calculate percentage of completion.

| ( a ) | ( b ) | ( c ) | ( b-c ) | ( b-c / a ) |

| Projected Total Costs | Actual Costs to Date | Uninstalled Materials | Actual Costs to Date (Adjusted) | Percent Complete |

| 800,000 | 400,000 | 100,000 | 300,000 | 38% |

The advantage of this approach would be identifying uninstalled materials by job. The disadvantage would be that calculated revenue based on the percentage of completion will not be correct, as this method will not include revenue up to uninstalled materials cost. To correct this, simply increase your revenue by the total amount of uninstalled materials.

Separate Zero Margin Job in WIP Schedule

The second approach would be to create a new line-item in your WIP schedule that would function as a “job.” This line would simply include uninstalled materials costs and would be set up as a zero-margin job. Projected billings, projected cost, and actual cost would all equal each other. This would allow revenue and costs to be calculated correctly and would be a very clean approach. A potential disadvantage would be an inability to see uninstalled materials by job. To correct this, simply create an “uninstalled materials” job for each job where this would be an issue.

No WIP Schedule Adjustment

The third approach would be to make no adjustment to the WIP schedule. At the end of each reporting period, collect all uninstalled materials costs at that point in time, by job. Then, apply the gross margin on each of those jobs to the uninstalled materials amount, and post a manual journal entry to debit materials costs and to credit contract liabilities/overbillings. This approach would reduce time incurred during the year, but the disadvantage would be that it will add time at the end of reporting periods to make the necessary adjustments.

The new revenue recognition standard ASC 606 brought significant changes on how to account for uninstalled materials. It is important to thoroughly understand this change and select the best method for your company to track uninstalled materials. For help selecting the best option for your company to use or to address any questions, please contact your KSM advisor.

Related Content

We're Looking for

Remarkable People

At KSM, you’ll be encouraged to find your purpose, exercise your creativity, and drive innovation forward.