Valuations Case Report: Using Rule of Thumb Benchmark Data To Verify Financials

This highlighted Business Valuation Resources case report serves as a reminder that rule of thumb benchmarks can be used as more than a safeguard to corroborate value conclusions. This data can also provide comfort to historical financials used in valuation analyses.

Cash-intensive businesses are particularly susceptible to financial manipulation, such as unreported income or running exorbitant amounts of personal expenses through the business. Using rule of thumb benchmarks comparing profitability to a subject company may be useful in indicating that further investigation is needed.

If you require the perspective of a valuation services professional, we’d love to discuss how KSM can help. Please contact a member of our team or complete this form.

Using Rule of Thumb Benchmark Data To Verify Financials

In addition to being used as a check to corroborate a value conclusion reached using other methods, rule of thumb data can be used to validate historical financials. This is particularly useful when valuing cash-intensive businesses.

Case in point. Several years ago, an appraiser was valuing a pizza shop as part of a marital dissolution engagement. The wife, who was the nonowner spouse, engaged the appraiser. When examining the financials, the net income of 1.7% seemed low, so the analyst checked a few reference sources. The Business Reference Guide indicated a net income of approximately 6%, and RMA showed a net income of approximately 5.1% in the current year with a 10-year net income to sales ranging from a low of 3.1% to a high of 5.1%. This raised a red flag and prompted the analyst to investigate, which ended up uncovering a material amount of unreported income on the part of the business-owner husband. When confronted with the proof, the husband quickly settled the matter on very favorable terms for the appraiser’s client.

Of course, rule of thumb metrics are estimates and are not meant to indicate where a particular business should fall because some businesses naturally are better than the industry, while some are worse. But they can serve to indicate when something may need further investigation, such as signs of financial manipulation.

Cash-intensive businesses are particularly susceptible to financial manipulation. In some cases, the manipulation is to avoid paying taxes, while others are more deliberate and intended to hurt a particular person. This often happens in matrimonial actions and shareholder disputes. When working on an engagement, it is not uncommon to find that an action came as a surprise to one party and then we discover that the other party was planning this for months or even years. In cases such as this, we as professionals need to be more skeptical of the information and data received.

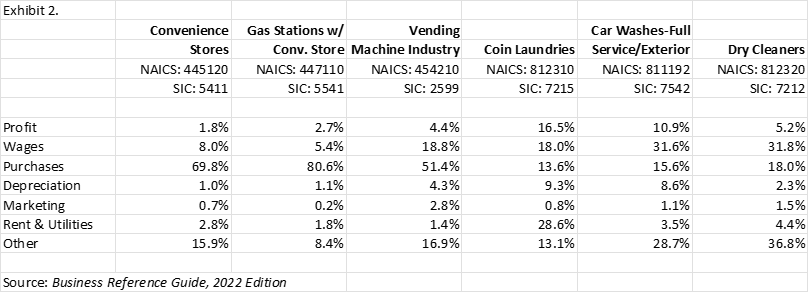

Eating places are common examples of cash-intensive businesses, such as pizza places, coffee shops, delis, donut shops, fast-food chains, and the like. Exhibit 1 contains some benchmark data from the Business Reference Guide (2022 edition) for some of these establishments. Other types of cash-intensive businesses are convenience stores (including ones with gas), liquor stores, vending machine operators, and many types of retail stores. Exhibit 2 contains some benchmark data on some of these businesses.

Exhibit 1. Benchmark Data for Certain Types of Eating Places

Exhibit 2. Benchmark Data for Certain Cash-Intensive Businesses

Related Content

We're Looking for

Remarkable People

At KSM, you’ll be encouraged to find your purpose, exercise your creativity, and drive innovation forward.