Mastering the Revenue Cycle: A Comprehensive Guide for Physician Practices (Part 1)

This is the first article in a three-part series on mastering the healthcare revenue cycle for physician practices. Part two explains key stress points and solutions to protect against failure. Part three covers how to assess and measure revenue cycle performance.

Physician practices are subject to many of the economic forces affecting all businesses, such as rising labor costs and changing consumer habits, but they are also subject to some unique pressures that are compounding the impact of the latest economic downturn. Reimbursement reforms, delivery system innovations, and new models for consumer-focused healthcare have profoundly influenced provider compensation, patient satisfaction, practice financial statements, and the regulatory compliance process practices must follow to qualify for critical government programs. With so many of these macro-level factors combining to drive down the amount of physician reimbursements at a time when labor and other practice costs are increasing, effective management of the revenue cycle has become a critical survival skill for physician practices.

The Physician Practice Revenue Cycle: An Overview

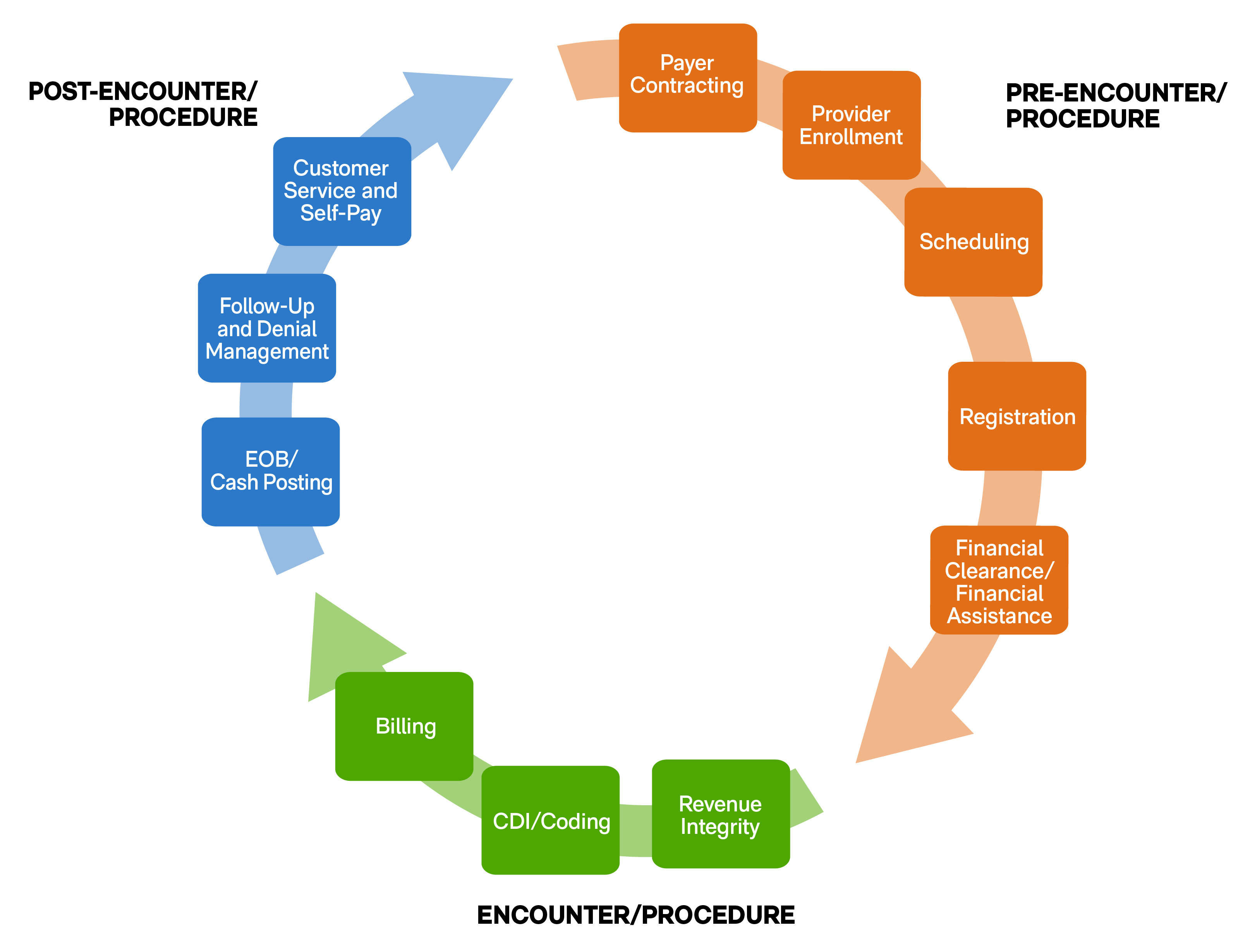

To manage the revenue cycle effectively, it helps to consider where the components fall along the timeline of the practice’s interaction with the patient. The life of a claim can be divided into three parts based on when each step should be taken. They are:

- Pre-Encounter/Procedure: Before an encounter or procedure even begins, physician practices need to establish a contractual relationship between the providers and the insurers who will provide the primary reimbursement for patient services. This also includes the creation of a process that combines patient scheduling, registration, and qualification for any financial assistance as part of the pre-visit cycle. These initial discussions with patients should cover the eligibility of the procedures as outlined by the insurers and the financial expectations of the patient for amounts not covered by insurance. It’s also the time in the revenue cycle to confirm 100% accuracy of patient information to ensure that all necessary referrals are on file and, in some cases, to collect copayments if the amounts are known.

- Encounter/Procedure: During the encounter/procedure, the care team should focus on the completeness and accuracy when documenting the care provided to the patient. Based on the documentation, billing codes are assigned for the services provided.

- Post-Encounter/Procedure: Once encounters/procedures have been coded, claims are generated, scrubbed, and submitted to the payers. The accounts receivable, payment posting, and denial management teams work on resolving the outstanding accounts receivable balances.

Assessing the Health of a Physician Practice’s Revenue Cycle

To understand where a physician practice may be missing key opportunities to improve the management and performance of its revenue cycle, it helps to see where certain common mistakes occur in the process. Every step in the cycle in the figure above has a corresponding pitfall that can slow down the process of reimbursement for a physician’s services, such as the following:

- Provider enrollment can be short-circuited by the failure of a physician to enroll with the patient’s insurer as of the date of service.

- If patients aren’t properly registered in the physician’s office and their insurance is not verified in advance, the practice can find out too late that a procedure was not covered under a policy or that a referral requirement was not met. That results in an unauthorized procedure that the patient’s insurance may refuse to cover.

- The failure to collect known copayments before a procedure can have a significant impact on the turnaround time for the practice to recognize revenue from the physician’s efforts.

- Failure to maintain accurate and complete documentation during patient visits and procedures can result in inappropriate coding of activities. These errors generate disputes in the billing process that increase the time needed to collect revenue from insurers and can result in inappropriate reimbursement for the services performed.

- Sloppiness in documentation and coding can also lead to missed charges altogether, resulting in foregone revenue.

- Following the submission of the bills for insurance payment, the practice must remain vigilant to make sure that the remittance advice from payers accurately reflects payment for the codes billed and that payments match the contracted payment schedules.

- Any denials must be identified and addressed as quickly as possible, and amounts that are the patient’s responsibility must be billed in a timely manner.

What’s Next?

Identifying revenue cycle pitfalls begs the question: What needs to be done to fix it? The next blog in this series will take a closer look at best practices for optimizing practices’ revenue cycles so they can be confident that every aspect is operating at peak efficiency.

To learn more about possible improvements to your practice’s revenue cycle management, please contact KSM’s healthcare consulting team or complete this form.

Related Content

We're Looking for

Remarkable People

At KSM, you’ll be encouraged to find your purpose, exercise your creativity, and drive innovation forward.